Alpen Capital today announced the publication of its GCC Insurance Report as a part of its Industry Research services. The report assesses the current market scenario in all GCC countries in order to understand demand-supply dynamics, growth drivers and future outlook and analyzes the performance of the industry players.

"The insurance industry in the Gulf Cooperation Council (GCC) has experienced steady growth on the back of economic development, population expansion, improved regulatory environment, and increased product awareness", says Sameena Ahmad, Managing Director, Alpen Capital. She continues, "Low insurance penetration, despite strong underlying growth drivers, continues to offer ample opportunities to insurers in the GCC. The region’s insurance sector is also expected to structurally mature going forward, in line with positive regulatory developments and efforts by some players towards attaining greater operational scale and efficiency". "We see several opportunities in the GCC Insurance sector with the bigger players in the insurance market getting bigger and thereby leading to the marginalization of smaller players. Low insurance penetration has also attracted several foreign insurance players who are now looking at establishing their footprint in the GCC." says Sanjay Vig, Managing Director, Alpen Capital.

The GCC Insurance Industry Outlook

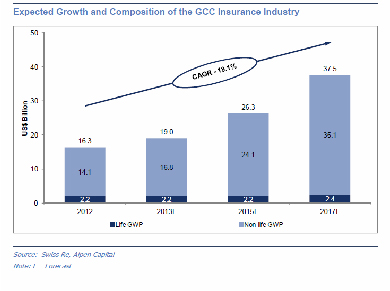

Alpen Capital estimates that the Insurance industry in the Gulf is projected to expand at a compounded annual growth rate (CAGR) of 18.1% between 2012 and 2017 to reach a size of US$ 37.5 billion, split between life (US$ 2.4 billion) and non-life (US$ 35.1 billion) segments.

The life insurance segment is expected to grow at an annual average rate of around 2% during this period. However, the non-life segment is forecast to expand at a much higher rate of 20.0% annually, thus increasing its share in the regional market from 86.6% in 2012 to 93.6% in 2017.

The non-life insurance segment is likely to benefit from the strong momentum of construction and infrastructure activities. A vast portion of oil revenues in the GCC countries is being diverted to the development of the non-oil segment for supporting economic diversification. This is giving a strong impetus to the construction sector, and in turn, to the region’s non-life insurance segment. Moreover, higher penetration of medical insurance and growth of motor insurance due to new vehicle sales are also likely to aid the segment’s growth.

The insurance penetration in the GCC is expected to improve from 1.1% in 2012 to 2.0% in 2017 , as industry growth comfortably exceeds the pace of GDP expansion. Non-life insurance penetration, which is likely to surge from 0.9% to 1.9% during the period, is seen as the main driving factor.

By 2017, insurance density in the Gulf is anticipated to more than double from the 2012 level as increased number of people and businesses avail insurance cover. Industry-wide density is likely to increase from US$ 367.3 in 2012 to US$ 751.4 in 2017. However, the gap between density in the life insurance and non-life segments is projected to widen substantially, going forward.

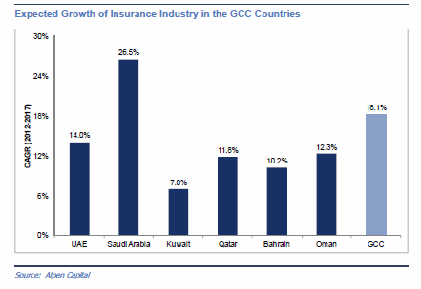

United Arab Emirates (UAE) and Saudi Arabia remain the largest insurance markets in the GCC while Saudi Arabia may surpass the United Arab Emirates (UAE) as the largest insurance market in the region going forward. The Saudi insurance industry is seen as a major driver behind growth of the GCC insurance industry as it is anticipated to expand at a CAGR of 26.5% between 2012 and 2017.

Key Growth drivers

Demographic factors like an expanding population base, large representation of foreigners, and increasing life expectancy are expected to have a positive impact on demand of insurance products in the Gulf and create increased awareness.

Sustained economic growth is likely to support expansion of the general income levels of people. Between 2012 and 2017, GDP per capita at purchasing power parity (PPP) in all the Gulf countries is projected to experience a positive growth of 2%-4% . This, alongside a median age of less than 30 years in most of the countries, suggests a strong propensity of residents to spend on automobiles and residential properties, translating into demand for related insurance products. Government investments in various sectors for promoting economic diversification are likely to provide new underwriting opportunities.

Implementation of compulsory health insurance programs in different jurisdictions is likely to create strong growth avenues for insurers. The impact of new vehicle sales growth is also expected to cascade on the insurance industry.

Role of the Takaful sector in increasing acceptability for insurance in the Gulf is recognized strongly, and the regulatory framework and operational metrics specific to this market is likely to undergo positive changes as the industry evolves. Eventually, new and innovative product offerings are expected to generate higher demand for family Takaful products in the Gulf. The sector is expected to launch a strong recovery, and grow at a CAGR of 23.0% between 2011 and 2016 to US$ 1.2 billion.

Business and financial hubs like Dubai International Financial Centre (DIFC) and Qatar Financial Centre (QFC) have significantly contributed to the growth of the regional insurance industry. These centers are home to a number of insurance and reinsurance companies, and insurance intermediaries.

Industry Trends

Competition from foreign players :Foreign insurers are expected to further augment their presence in the Gulf as they benefit from higher technical know-how, distribution capabilities, customer orientation, and financial strength.

Focus on ERM: Enterprise Risk Management (ERM) is still in the development phase in the region. However, insurance companies are increasingly sensing the need of having more robust and systematic risk management processes for the future.

Adoption of unified insurance system: The proposed unified insurance scheme for automobiles may bring about some standardization in insurance rates across the region. It may also pave way for more unification measures within the insurance sector.

New distribution channels: Modern distribution channels like Bancassurance and online policy approvals are increasingly becoming popular. Islamic banks are likely to emerge as an important medium in the marketing and sales of family Takaful products.

Changing Investment mix: In efforts to generate assured returns and mitigate volatility in investment income, the regional insurance companies have increased their investments in relatively low-risk instruments while reducing their exposure to equities.

Emergence of new segments: The concept of captive insurance, although still at a nascent stage in the GCC, is exhibiting a strong growth potential as economic development and expanding business operations increase the complexity and quantum of risks. Further, with a number of construction projects being undertaken, insurance companies may see a robust growth in demand for issue of surety bonds.

Challenges

The insurance industry though small faces quite a few challenges.

Insurance industry in the Gulf is currently over-crowded as a number of domestic and international companies serve the limited sized market. Competition is particularly intensive in personal insurance lines like motor and medical.

Development of the regulatory environment in the Gulf’s insurance sector is considered inadequate. Some of the major deficiencies sighted in the framework are a less sophisticated solvency regulation, low transparency standards, and insufficient guidelines to regulate investments of insurers. Further, there is a wide range of regulatory discrepancies across the region.

Industry-wide profit margin in the GCC has been on a downtrend for the last several years, primarily reflecting diminishing profitability in technical operations, an inefficient operating model and low scalability, and falling investment yields.

The insurance sector faces severe shortage of skilled local workforce. This has, in turn, affected the underwriting and risk-bearing capabilities of companies while increasing their operating overheads.

Awareness about insurance and its benefits remains low among the typical GCC consumers and small and medium businesses. Many fail to recognize insurance as an effective means of wealth protection, savings, and security.

Prolonged global economic uncertainty has posed substantial challenges to insurance companies by creating volatility in investment values and returns. Further, due to the Eurozone’s debt crisis, demand for marine insurance may remain muted.

The Arab uprising has heightened concerns of overall political instability in the Middle East region. Recurrence of such events may disrupt the general business and investment climate, and cause a sudden spike in insurance-related claims.

Although the sector has continued its upward trend, it is still relatively underdeveloped and key market indicators trail the world average by a large margin. However, fundamental industry drivers suggest solid growth prospects and we expect the sector to grow and evolve further in line with positive regulatory developments and efforts by some players towards attaining greater operational scale and efficiency.

Please click here to access the GCC Insurance Industry Report online.

Back

Back